6 Ways to Avoid Fraud

Avoid Becoming a Victim of Fraud

6 Ways to Avoid Fraud

Table of Contents

There are many ways to avoid fraud and protect yourself against becoming a victim of fraud. Life gets busy and hectic which can lead to unintentional mistakes. Tragically, those mistakes can lead to you becoming a victim of fraud. Below is a list of 6 ways to avoid fraud and how protect yourself, your business and your family from fraud.

Safe Internet Use:

Practicing safe internet use is one of the ways to avoid fraud. The bullet points below provide more specifics.

- Open Wi-Fi Hotspots: Never use open Wi-Fi hotspots like in a coffee shop without using a Virtual Private Network (VPN). All phones, tablets and laptops have the ability to activate a VPN connection. Without using a VPN when connected to open Wi-Fi hotspots you are granting access to everything on your phone, table or laptop. Fraudsters will grab all the information they want and place a malware, ransomware or spyware software on your device.

- Antivirus and Anti-Spyware software: Ensure your antivirus software is up to date and active. Antivirus software can protect you from most malware and spyware viruses. However, they are not a guarantee to keep your information safe.

- Sharing Personal Information: Never share your personal information, bank information or credit card information over email or social media.

Safe Credit Card Use:

Practicing safe credit card use is essential to protecting your money. Most of our assets are tied, in some way, to our credit cards. Below are several bullet points highlighting other ways to avoid fraud.

- Always check the Point-of-Sale (POS) credit card reader to ensure it does not have a fake cover on it. This fake cover is used to copy all of your credit card information. Read more about this activity called “Skimming”.

- Protect your PIN when entering it on the keypad. Use hour hand or any other object that will obscure your PIN from onlookers.

- Never send your credit card information to anybody on email, text or other messaging apps.

- If possible, purchase a credit card holder that has NFC (Near Field Communications) protection. This will prevent anybody from stealing your credit card information by simply getting close to your wallet or purse.

Social Media and Security Settings:

Social media is ripe for fraud. Ensuring your privacy and security settings are strong highlights other ways to avoid fraud.

- Be careful with whom you connect with on social media platforms. If you don’t know the person, do not accept a friend request. Not even if you have common friends. If you do get a friend request from someone you know, ensure they aren’t already in your friends list. If so, reach out to them to find out if they created a second profile. Chances are it’s a fake profile with the intent of collecting your personal information.

- Learn how to use your privacy and security settings on all social media platforms. If you recognize suspicious behavior, clicked on spam or have been scammed online, take steps to secure your account and report it.

- Do not make all of your social media posts public. Doing so makes it very easy for fraudsters to steal your identity. The whole world does not need to see everything about your life. If you are one of those who feel they must, then you will become a victim of financial fraud. It’s just a matter of time.

- Scammers are known for using your information and images to create a fake identity or target you with a scam.

Online Shopping:

Online shopping is something most of us do on a regular basis. And during the COVID lockdowns almost everybody shopped online. Probably way too much! Not paying attention to how you’re are purchasing online puts you at risk. These 6 points are ways to avoid fraud.

- Offers that look and sound too good to be true, they more than likely are. Remember, nothing is free. You will pay for it in some way or another.

- Only use online shopping services that you know and trust. Fraudsters commonly stand-up fake shopping websites, only to steal your money.

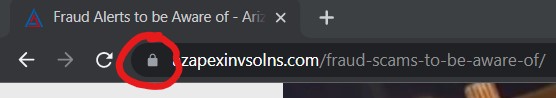

- Ensure that the browser address shows a closed lock.

- A closed lock, as seen above, is an indication that the website is using HTTPS and SSL security encryption. Typical scammer websites are not secured in this manner.

Suspicious Communications:

Suspicious communications include text and email scams. These scams have drastically increased in volume and cleverness. The fraudsters have become very crafty on how they word almost everything. But following these additional steps are other ways to avoid fraud.

- Never open email attachments from unknown senders.

- Never click links on emails from unknown senders.

- Never click on links in pop-up windows.

- Never click a link sent to you in text from a phone number longer than 5 digits. These are typically blast scam texts. They send blast text messages to dozens of phone numbers at a time, knowing that at least one person will click the link.

This same rule goes for email links from bulk sent emails. DO NOT rely on Google or Yahoo to flag the message as spam or phishing. - Never give your personal information over the phone where you did not initiate the call. Scammers, usually in India, are in call centers and call thousands of phone numbers a day trying to scam people.

One trick to be aware of is if you get a call from a number not in your contact list, and you answer the call, if there is a several second long pause on the other end of the line before someone talks. That’s a call center doing blast marketing or blast scamming.

Strong Passwords:

Strong passwords may seem complicated, but they aren’t. Follow these simple rules to ensure you do not become a victim of fraud. These additional bullet points will augment ways to avoid fraud.

- Always create strong passwords. And no, “Password” is not a secure password. Ensure the password is hard to guess, is not your birthdate, SSN or variations of your name. Strong passwords have mixed upper and lower-case letters, numbers and a special character. You can use a phrase with the items previously mentioned to make it easier to remember.

- Never use the same password for everything. Once your password is compromised, you’ve given the fraudster the keys to everything.

- Use a secure password storage application like NordPass or KeyPass to safely and securely store all of your passwords. Both applications can run on your phone, tablet or laptop.

- Last, but certainly not least… NEVER share your passwords with anyone.

Here is another article by the FTC Consumer Advice page on other ways to avoid a scam

The 6 ways to avoid fraud listed above can be augmented by reading our article on 3 Steps to Identify Phishing Scams.

Here are a few links to Annuity.org that covers Financial Literacy, Annuity Scams, and a Seniors Guide to Financial Scams:

https://www.annuity.org/financial-literacy/seniors-guide-to-financial-scams/

https://www.annuity.org/scams/

https://www.annuity.org/financial-literacy/financial-abuse/

Read more about other types of fraud you should be aware of.

Key Takeaways

- 6 Key Takeaways on ways to avoid fraud.

- Practice safe internet usage techniques:

- Don’t use open Wi-Fi hotspots without using a VPN.

- Ensure your antivirus software is up to date and active.

- Never share your personal information

- Practice safe credit card use:

- Always check the Point-of-Sale (POS) credit card reader to ensure it does not have a fake cover on it.

- Protect your PIN when entering it on the keypad.

- Never share your credit card information to anybody over email, text or other messaging apps.

- Use a credit card holder that has NFC (Near Field Communications) protection.

- Social Media and Security Settings:

- Do not accept a friend request from someone you do not know.

- Learn how to use your privacy and security settings on all social media platforms.

- Do not make all of your social media posts public.

- Online Shopping:

- Offers that look and sound too good to be true, more than likely are.

- Only use online shopping services that you know and trust.

- Ensure that the browser address shows an SSL security lock.

- Suspicious Communications:

- Never open email attachments from unknown senders.

- Never click links on emails from unknown senders.

- Never click on links in pop-up windows.

- Never click a link sent to you in text from a phone number longer than 5 digits.

- DO NOT rely on Google or Yahoo to flag the message as spam or phishing.

- Never give your personal information over the phone where you did not initiate the call.

- Use Strong Passwords:

- Ensure the password is hard to guess, is not your birthdate, SSN or variations of your name.

- Never use the same password for everything.

- Use a secure password storage application like NordPass or KeyPass to safely and securely store all of your passwords.

- NEVER share your passwords with anyone.

- Practice safe internet usage techniques: